Why are 402 out of 500 S&P companies implementing diverse, equitable, and inclusive business practices?

Although DEI – diversity, equity, and inclusion – has increasingly become part of business strategies worldwide, back in 2020, only 72 of S&P 500 companies included it in their annual reports. This translates to an increase of 550% in the adhesion of the largest companies in the US stock market to the DEI practices – in only one year.

Besides the top-down efforts, social events strongly impact business, and consumers actively demand corporate social responsibility. In this sense, the reverberation of the murder of George Floyd, an African-American man brutally murdered by a white police officer in Minnesota during an arrest in 2020, was exponential, as the strength of the Black Lives Matter (BLM) movement protests. In the aftermath of Floyd’s execution, the hashtag #BlackLivesMatter was used on average 3,7 million times daily. Additionally, an analysis of 50 million Twitter posts between 2013 and 2021 observed an online public more engaging in topics related to racial equity. People from underrepresented communities and allies raised their voices against racism, claiming for structural changes and “compelled institutions to act”, – said historian Robin DG Kelley.

However, we need to distinguish companies willing to promote long-term structural changes from companies that are taking these events as a chance to do “slackativism,” a frequent practice based on superficial support for social causes with the means to gain marketing recognition rather than promoting the change.

Source: Jakayla Toney

What is really changing: how are S&P 500 companies embracing DEI?

The Wall Street Journal developed a ranking to evaluate DEI themes among S&P 500 organizations. The analysis was based on ten metrics, considering the percentage of women in leadership positions, the board composition, age, and ethnicity of employees, and the existence of DEI programs. The methodology scored each company from 0 to 100 – with 100 being the most DEI. Comparing the industries, the financial sector was considered the most diverse (scoring 50,4); the communications sector occupied second place, and the materials sector ranked last. Among the companies, Progressive Corporation holds the top ranking (scoring 85 points), followed by the global leader in financial services, J.P. Morgan (80 points).

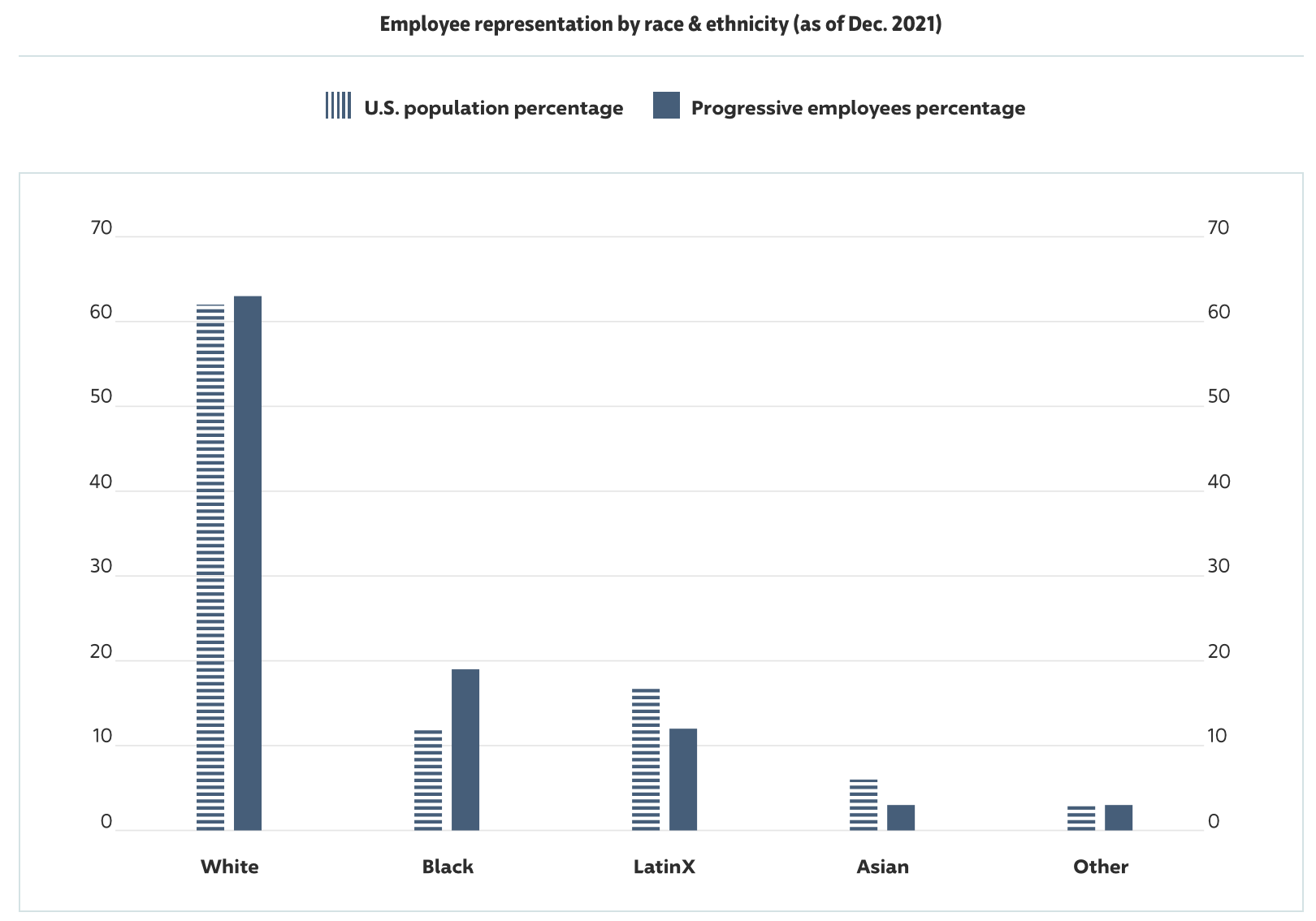

Progressive Corp. made public their U.S. Equal Employment Opportunity report presenting the demographic details of their employees juxtaposed to the US population as the demographic representation in leadership positions. As DEI & You Consulting highlights, collecting and analyzing the company’s data is an essential first step to understanding the organization’s strengths and weaknesses regarding DEI.

Employee representation by race and ethnicity (Dec. 2021): US population x Progressive Corp. employees

Source: Progressive Corp.

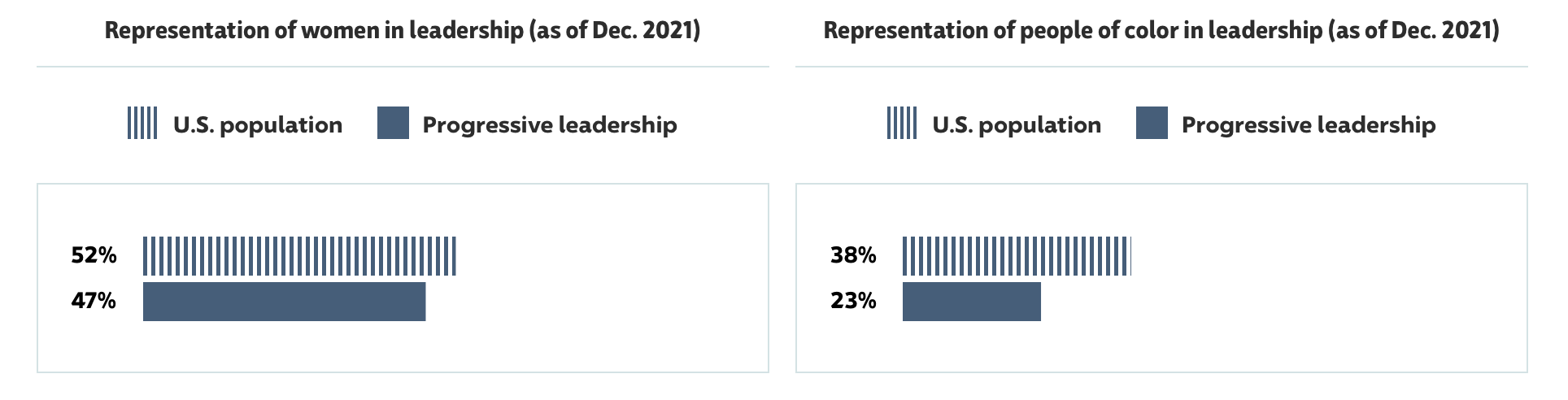

Representation of women and people of color (POC) in leadership positions at Progressive Corp. contrasted to the US population (Dec. 2021)

Source: Progressive Corp.

Focusing on leadership positions, they aim to jump from 10% to 20% of the representation of POC in leadership positions by 2025. Besides the numbers, their efforts include initiatives to promote equal pay: women with similar performance, experience, and position, earn one dollar for every dollar earned by men as POC compared to white co-workers. Brookings reveals that, on average, women make 79 cents for every dollar men earn. But Black women make only 64 cents on the dollar, and Latinas only 54 cents.

Source: Alexander Suhorucov

What benefits are these companies experiencing?

The Wall Street Journal evaluated that the 20 most diverse S&P 500 companies outperformed in share price and operating results: with an average operating profit margin of 12% (compared to 8% of their peers). Besides, companies with diversified leaders have 10% higher EBIT margins than companies with below-average managers.

Nevertheless, this innovative escalation is restricted to companies that embed DEI into their culture and values, promoting a structural change that involves – and is supported by – the leaders. Collecting and analyzing your company’s data is essential to start your DEI journey. Still, it is also important to identify how effective the already implemented programs are: a survey asked managers if they invested in DEI initiatives: 98% said yes. Then, the interviewers turned to the employees who should benefit from these programs: only 25% answered they benefited from these efforts.

Since DEI is not genuinely embedded into their culture, these companies will not benefit from business advantages, and financial performance is just one of a series of missing opportunities. As Professor Katherine Phillips explains, “diversity jolts us into cognitive action in ways that homogeneity simply does not”, being a factor that improves the decision-making process, the risk management – since there are multiple viewpoints considered in the analysis – and it expands the market opportunities – because different groups can provide a broader review of tendencies and windows of opportunities for products and services. For instance, women control 51% of US wealth and influence directly or indirectly 80% of all purchases – so you need to have a team that includes representatives of this group to reach this market successfully.

Source: fauxels

The remaining challenges

The Wall Street Journal explains that the largest companies on the list were more likely to embrace DEI. The reason is their higher exposure to social scrutiny and the greater quantity of available resources. This information leads us to a conclusion: instead of embedding DEI into the company’s culture and benefiting from it, many organizations see it as an extra expense, resulting in a loss of business opportunity.

Racial inequality in major instances of power is a second significant challenge for organizations to overcome. One strategy is to draw a long-term program to invest in the company’s human capital. Leaders can launch development training programs to guarantee their employees an organic growth within the company. Mentoring programs are also an important initiative: Black Harvard MBAs who achieved management positions (13% of women, 19% of men) had been bolstered by networks of supporters.

David Taylor, P&G’s CEO, stated, “a diverse team supported by an inclusive environment that values each individual will outperform a homogenous team every time.” He believes that DEI is one of the pillars that boosted the company to the recent financial results, including a 5% growth in organic sales in 2019. In this sense, diverse teams cannot promote change if the company’s atmosphere does not underpin equity and inclusion: it needs to be a combination of factors sustained by the organization’s governance. DEI can be a magnificent source of advantages when authentically immersed in the company and supported by the leaders, which is the current major challenge.

Continued Learning:

- See “Diversity confirmed to boost innovation and financial results” – Forbes

- See “Toward a Racially Just Workplace” – Harvard Business Review

- Check out Janet Stovall’s TED Talk “How to get serious about diversity and inclusion in the workplace”

- Check out Rocío Lorenzo’s TED Talk “How diversity makes teams more innovative”

ABOUT THE AUTHOR

![Bruna [small]](https://deiandyou.com/wp-content/uploads/2022/05/Bruna-small.png)

Bruna Bauer is the DEI Social Media and Marketing Intern.

Bruna believes the world is naturally diverse, but now it is time to become inclusive and equitable. She supports that society and the environment are connected, and sustainable solutions must integrate both.

Redefining Activism: New Trends in Allyship for the Upcoming Years

Picture a chessboard. At its center, two pieces stand mirrored, symbolizing the strategic interplay of equity and inclusion, the key...

Navigating DEI in Tech: 4 Steps Towards Ethical Algorithms and Inclusive Data Privacy

In our fast-paced, technology-driven world, personal data has become a hot topic. Every click, every purchase, every post - they all...

Maximizing DEI Metrics: 5 Ways to Elevate Your DEI Strategy Through Data Collection

Four ascending bar graphs measuring the DEI metrics of your organization When diversity, equity, and inclusion (DEI) work is...

Redefining Activism: New Trends in Allyship for the Upcoming Years

Picture a chessboard. At its center, two pieces stand mirrored, symbolizing the strategic interplay of equity and inclusion, the key...